Raphaëlle Mueller, Abstract Rules For Precise Operations °2 - Post Natural Conditions, 2019, média mixtes, boucle vidéo. Installation dans le cadre de l’exposition collective TRANSIT (Permission to pass through), Live In Your Head, Genève, Suisse.

Œuvres

Abstract Rules For Precise Operations °2, Live in Your Head 2019

Raphaëlle Mueller

Abstract Rules For Precise Operations °2 - Post Natural Conditions, 2019 Média mixtes, boucle vidéo

Photo © Raphaëlle Mueller

Statement

In English (résumé français ci-dessous):

This ongoing research project investigates the field of political ecology by focusing on both the financialization of nature and commodification of pollution. These take the hallmark shape of carbon trading, ruled by a neocolonial logics of petrocapitalism, or as it has been rechristened: “green capitalism”.

By signing the Kyoto Protocol in 1997, over 190 countries committed to reducing carbon emissions between 2008 and 2012. Further, the Protocol grants signing countries with surplus emission credits the right to sell these to another country, thereby creating a new, multibillion-dollar international market for carbon emissions. But let’s first remember what lies at the core of capitalist modernity: accumulation of profits, markets, commodification, short term perspective, massive inequality, standardisation, extraction, exploitation, expropriation, stocks. It seems therefore obvious that globalised financial markets are anything but durable and eco-systemically ethical. The quest for short- term profit and logic of shareholder-value are in total contradiction with the requirements of social and environmental sustainability. Moreover, the last IPCC report highlights that carbon emissions set a record in 2018 with 48 gigatons of CO2 released in the atmosphere—against 37.1 Gt in 2017. It tells a lot about the so-called Kyoto Protocol regulation efforts. Instead of durably cutting back emissions, greenhouse gases such as carbon dioxide are being commodified and traded via the complex apparatus of carbon pricing. The market operates with irrational exuberance, ruled by both human and non-human intelligence, in the age of high-frequency trading and algorithmic decision-making.

One side of the carbon trading story is the carbon offset, a reduction in CO2 emissions or greenhouse gases intended to compensate for other emissions.

Under that scheme, major companies buy carbon credits from countries that agree to plant trees or protect existing forests, and a new market for carbon- capturing technologies is on the rise. Carbon offset programs thus act as new ways of commodifying and privatising air, forests, plants and soil. According to Tom B.K. Goldtooth, Executive Director of the Indigenous Environmental Network, “Under the rubric of carbon pricing, these cap-and-trade, carbon offsets, carbon tax systems are false solutions that do not cut emissions at source, create toxic hot spots, and result in land grabs and violations of human rights and rights of Indigenous peoples in the forest regions of developing countries.”

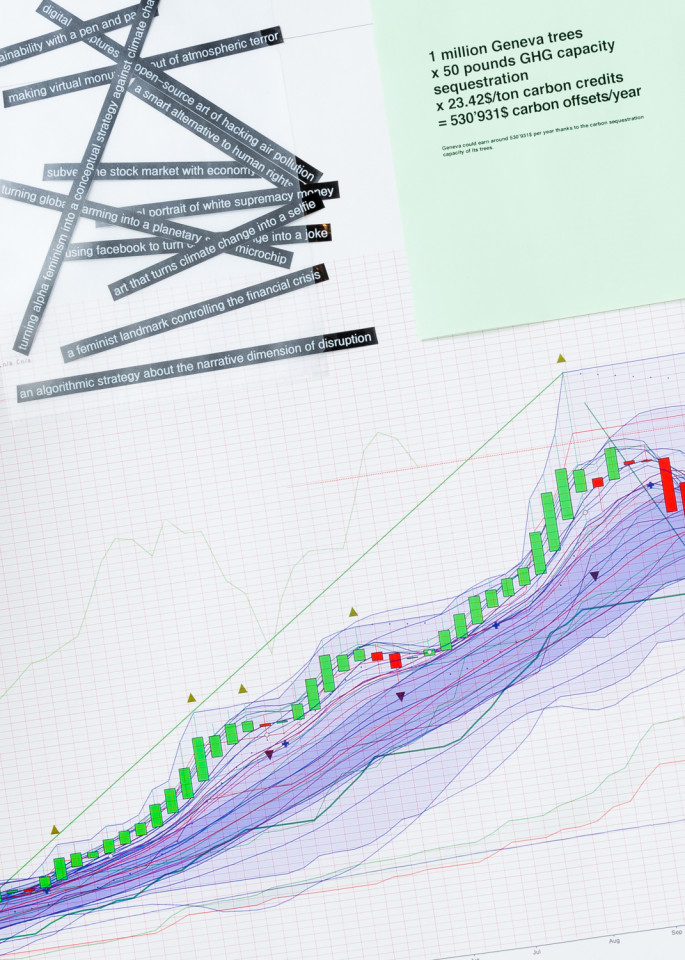

Since earthly survival and conditions of liveability are under dire pressure and command a drastic cutback in carbon emissions, these trading practices, as well as the greenwashing propaganda spread by the global governance and big corporations, must receive close scrutiny. But then, how might we operate a translation of invisible realities, abstract flows and entities? How might we visualise capital? And show the commodities of our time? The data aesthetics (charts, statistics) is one dominant mode of address in the trading realm. One way to discuss political and economic conditions is to examine their (re) presentations. The present setup displays several strategies to engage with these questions and issues. The video Synthetic Futures °7 shows an in situ virtual sculpture whose formal aspects are determined/generated by actual trading activities (carbon emissions futures and crude oil futures), merged with the data of annual global carbon emissions. Transferring the politics of aesthetic to algorithms—thereby causing shapes and colours to fluctuate, following abstract rules but precise operations—brings on formal hazard and undermines the artist’s agency. At the bottom is a Carbon Emissions Futures Chart, extracted from a trading platform and showing how this commodity fluctuates over a specific period (2014-present). Since information is power, the present chart depicts the accumulation of all possible analytical tools offered by the platform, thereby exacerbating the abstraction of an already abstract tool, meant to predict the unpredictable bullishness or bearishness of the market. The traders’ viewpoint—that of trading carbon credits—derives from the same trading platform, offering a sneak peek at the intimate world of carbon credits. Finally, the artist generated some ironic slogans addressing the issues of art’s relation to politics, finance, power, technology, ideology, and representation. These are not merely diagrams. They proceed from an attempt at distancing and defamiliarisation, thereby showing information and subverting it.**

Résumé en français:

Ce projet de recherche explore le champ de l’écologie politique à travers la financiarisation de la nature et la marchandisation de la pollution. Leur marqueur emblématique : le trading de crédit carbone, que régit une logique néocoloniale de pétrocapitalisme, rebaptisée «capitalisme vert». En signant le protocole de Kyoto en 1997, plus de 190 pays se sont engagés à réduire leurs émissions de gaz à effet de serre entre 2008 et 2012. Le protocole accorde aux pays signataires dotés de crédits d’émission excédentaires le droit de les vendre à un pays tiers, créant ainsi un nouveau marché de plusieurs milliards de dollars.

Dans le cadre de ce programme, les grandes entreprises achètent des crédits de carbone à des pays qui acceptent de planter des arbres ou de protéger les forêts existantes et un nouveau marché de technologies de capture de carbone se développe. Sur une idée qui semble séduisante, les programmes de compensation de carbone agissent en fait comme de nouveaux moyens de marchandiser et de privatiser l’air, les forêts, les plantes et le sol. Selon Tom B.K. Goldtooth, directeur exécutif d’Indigenous Environmental Network: «Under the rubric of carbon pricing, these cap-and-trade, carbon offsets, carbon tax systems are false solutions that do not cut emissions at source, create toxic hot spots, and result in land grabs and violations of human rights and rights of Indigenous peoples in the forest regions of developing countries.”

Étant donné que les conditions de vie/survie terrestre sont soumises à une pression extrême qui exige la réduction drastique des émissions de gaz à effet de serre, les pratiques du trading carbone - ainsi que la propagande écologiste répandue par la gouvernance mondiale et les grandes entreprises - doivent faire l’objet d’un examen minutieux. Comment opérer une traduction de réalités invisibles, de flux et d’entités abstraits ? Comment visualiser le capital ?

Raphaëlle Mueller